This market-timing model post boasts an impressive track record

The stock market’s prospects for the next 12 months are only modestly positive.

That’s the conclusion of a market-timing model based on the ratio of gold’s price GC00, +0.25% to platinum’s PL00, +0.15%. You might think it’s good news that equities’ 12-month potential is as promising now as it was in early 2021. But, in fact, most stocks have struggled since then. A relatively small number of large-cap stocks have propelled the S&P 500 SPX, +0.34% higher, and the Russell 2000 index RUT, +1.01% is 9.2% lower than where it stood when my early-2021 column on this gold-platinum ratio was published. The Nasdaq Composite Index COMP, +0.29% is just 1.8% higher while the Russell Micro-Cap Index is 14.7% lower. (Data, courtesy of FactSet, are through Mar. 28.)

The discovery of the gold-platinum ratio’s market-timing potential traces to a 2019 study in the Journal of Financial Economics. It showed that a rising gold-platinum ratio forecasts higher stock market returns over the subsequent 12 months and vice versa. Entitled “Gold, Platinum and Expected Stock Returns,” its authors are Darien Huang, a former finance professor at Cornell University, and Mete Kilic, a finance professor at the University of Southern California.

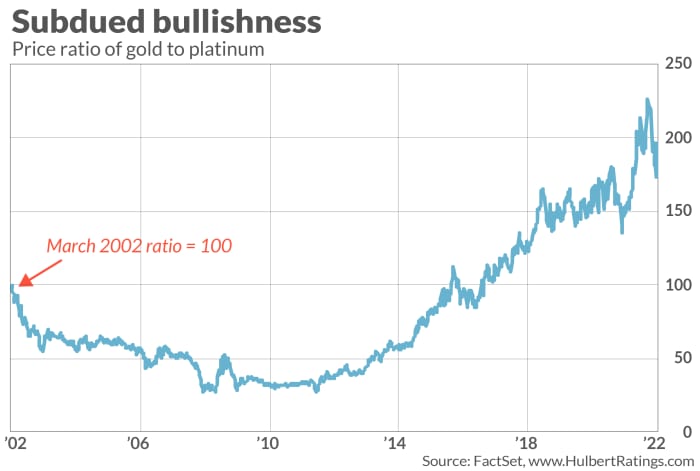

The chart below plots this gold-platinum ratio over the last 20 years. Notice that the ratio declined for many years prior to and including the 2008 financial crisis, correctly predicting less upside potential for the stock market. Since 2008, in contrast, the ratio has for the most part steadily risen — as has the stock market.

During the COVID pandemic of the past two years, the ratio has been highly volatile: It spiked in the wake of the market’s waterfall decline in March 2020, anticipating the market’s huge potential over the subsequent 12 months. Since then it fell, rose again, and over the past couple of months has fallen back.

The ratio works, according to the professors, because platinum and gold respond to different factors. While platinum primarily reflects changes in industrial demand, gold responds both to that demand as well as investors’ desire to hedge against economic and geopolitical uncertainty. By focusing on the ratio of gold’s price to platinum’s, you zero in on that portion of gold’s price that is a hedge against uncertainty. Since the stock market’s expected return is compensation for uncertainty and risk, this ratio should be particularly valuable to market timers.

That’s exactly what the professors found. Since 1975, the gold-platinum ratio has had a significantly better track record predicting the market’s subsequent 12-month return than nine other well-known indicators that other researchers previously found to have predictive ability — including, prominently, the Cyclically-Adjusted PE Ratio, or CAPE, made famous by Yale University (and Nobel laureate) Robert Shiller.

The ‘war puzzle‘

You might find it surprising that the gold-platinum ratio has fallen in recent months, which suggests that risk has declined. Yet in February Russia invaded Ukraine and, according to some, the conflict could lead to World War III. That certainly seems like the very definition of heightened risk.

In fact, however, the gold-platinum ratio decline in the wake of Russia’s invasion of Ukraine is not that unexpected. In academic circles, it’s been known for some time that the stock market tends to experience below-average volatility during wars and military conflicts — a pattern known as the “war puzzle.” According to a study that the National Bureau of Economic Research began circulating a couple of weeks ago, stock market volatility has been “33 percent lower during major wars and periods of conflict since 1921.”

The study, “Stock Volatility and the War Puzzle,” was conducted by Gustavo Cortes, a finance professor at the University of Florida; Angela Vossmeyer, an economics professor at Claremont McKenna College, and Marc Weidenmier, a research associate at Chapman College. They at least partially solved the puzzle, finding that increased defense spending during wars and military conflicts leads corporate profits to become more predictable. That in turn translates to lower stock market volatility and risk.

Regardless of whether this solves the “war puzzle,” the message of the gold-platinum-based indicator with a good market-timing record is that the stock market’s potential over the next 12 months is only moderately positive.