On Tuesday, the 2/10 yield curve inverted by -3bps (for a few minutes) and closed with a positive spread +2bps on the day. There are a number of factors that led to this incident, but one stands out from the crowd.

Ordinarily, an inversion would be caused after multiple hikes – with the 2yr yield climbing along with the Fed Funds rate – as the Fed attempts to drain liquidity and cool an overheated economy. However, this temporary inversion was caused by an exogenous event – the Bank of Japan. The BoJ intervened aggressively earlier this week to defend the 0.25% yield cap by offering to “buy an unlimited amount of government bonds for the first four days of this week.”

Under pressure from a steady rise in yields, the BOJ launched its defense by making two offers in a single day to purchase a 10-year Japanese government bond (JGB) in unlimited amounts at 0.25%.

The central bank then said it would make the same unlimited offer for the next three days, to make sure investors received the message loud and clear, but some economists believed the central bank’s grip on yield curve control was at risk of slipping.

“Markets may more forcefully test the BOJ’s resolve to defend the 0.25% ceiling, which may prompt the bank to modify its approach and allow the 10-year yield to rise more.”

The BOJ’s first offer for unlimited bond-buying in the morning failed to prevent the 10-year JGB yield from hitting a six-year high of 0.250% on Monday – the level the bank has set as an implicit cap around its yield target.

“Markets are putting the BOJ to test, so the central bank has no choice but to keep offering unlimited bond buying,” said Takafumi Yamawaki, head of Japan fixed income research at JPMorgan Securities.

“If yields are allowed to move above 0.25%, investors will think the BOJ has tolerated a rise above that level. That makes it harder for the BOJ to carry on with yield curve control.”

Under yield curve control (YCC), the BOJ pledges to guide the 10-year JGB yield to around 0% as part of efforts to stimulate the economy by keeping borrowing costs low.

So what does this have to do with our inversion? In recent weeks’ notes and podcast|videocast(s) I have made the case that the Fed needs to shift to balance sheet roll-off to drain liquidity OVER more aggressive rate hikes. In other words, they could cool the economy and re-steepen the curve (extend the cycle by multiple years – as lending is incentivized when the curve is steeper) by doing modest hikes (25bps per meeting) and selling long-duration Treasuries on the open market to sop up liquidity.

Opponents of this view fear that yields on the long end of the curve would blow out beyond control and our borrowing costs would become unsustainable. I have repeatedly made the case that foreign demand would step in major size between 2.25% and 2.50% on the 10yr. Tuesday’s action was clear evidence of this thesis. As managers’ yields were capped by the BoJ, foreign demand flowed into US Treasuries at ~2.50% and led to an exogenous cap at the long end of our curve. Simultaneously, “50bps hike” rhetoric – from several of the impatient and emotional “day traders” sitting on our Federal Reserve (FOMC) – caused the temporary inversion (which did not hold on a closing basis). The FOMC needs to have a little patience on the hikes (as they have so far) because at the end of the day:

-Are 50bps hikes going to make more semi-conductor chips and ease up the supply chain?

-Are 50bps hikes going to stop covid-19 in Asia so that the factories can stay open 24/7 to meet demand?

-Are 50bps hikes going to cause a negotiated settlement between Russia and Ukraine?

-Are 50bps hikes going to cause our diplomats to complete an effective deal with Iran to bring more supply online?

-Are 50bps hikes going to make this Administration complete the Keystone pipeline?

-Are 50bps hikes going to make this Administration issue more leases to drill on Federal land – as producers have done freely in the past?

-Are 50bps hikes going to incentivize our major banks to lend to our energy producers – when ESG managers/pension funds force them to limit lending to energy producers?

-Are 50bps hikes going to bring more supply of labor online and make more Americans re-enter the workforce (and cool rising wages) – when there are already 11.26M job openings unfilled?

If the answer to these questions (the primary causes of inflation) is NO, what is the purpose of hiking too fast, causing an inversion, and forcing the country into recession just 2.5 years after the last recession – OTHER than to pretend it’s going to bring down prices at the pump (and increase approval ratings/consumer confidence) before the mid-term elections? News flash, it’s not. You can’t create oil with monetary policy. Only effective Executive Orders that allow energy producers to do what they do best will work.

10yr German bunds have gone from -.10% yields to +.74% yields in 4 weeks. Our Fed’s policy is wreaking havoc on central banks around the world as they scramble to hold yields down. Expect more and more foreign central banks to follow the path of BoJ and institute yield curve control in the coming weeks and months. This will drive demand for longer duration U.S. Treasuries and give our Fed (if they are smart) the opportunity to lay off some of the balance sheet holdings and move MORE slowly with the short end of the curve hikes. When the ducks are quacking, feed them…

It’s an opportunity to “stick save” the inversion (as they did in 1994) and extend the cycle by a few more years.

So was Tuesday an actual inversion (that usually happens naturally at much higher levels – after multiple hikes – implying the intended slowing has worked) or is it a head fake due to the BoJ temporarily forcing managers to more attractive horizons in their demand for yield?

We lean to the latter, BUT even if it were the former (a clear inversion) it would not change our positioning our outlook for the equity markets in the near term (next ~6-9 months). What was a minority view that we put out publicly a few weeks ago when hedge funds were in the middle of their most aggressive selling (in the hole) since 2008, is still our base case: We believe the market will work its way to new highs in coming months.

9 Reasons To Stay The Course – For Now

Sagarika Jaisinghan, a reporter from Bloomberg, reached out to ask me the following question on Wednesday:

“Why are stock markets appearing so sanguine despite the fact that the Ukraine conflict is far from over and at a time when surging costs are threatening profit margins?”

To which I replied with these 9 points:

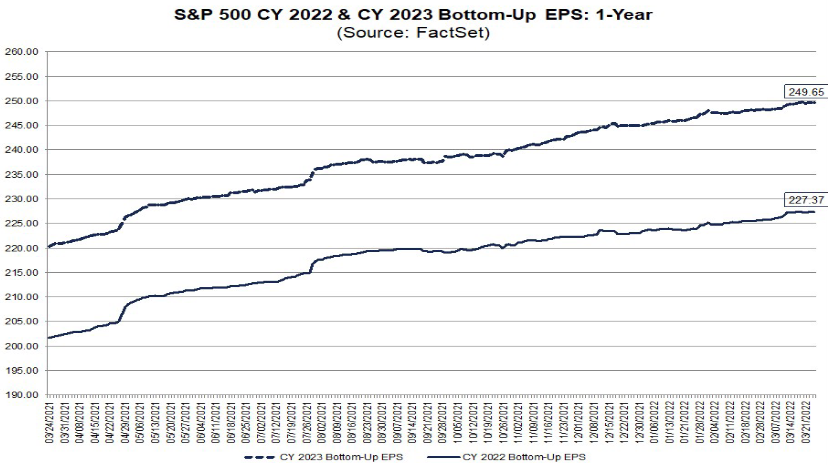

The number one reason the markets are sanguine is because earnings keep going up! 2022 estimates hit $227.32 this week up from ~$225 a month ago. Companies are passing costs onto consumers. Positioning just three weeks ago among hedge funds and institutions was it’s most pessimistic since 2008. Now they have to chase.

Many indicators are starting to point to alleviation of inflation:

1) Commercials are starting to sell grains (COT report).

2) Russia has limited its focus to the Donbas region – which will likely result in a negotiated settlement.

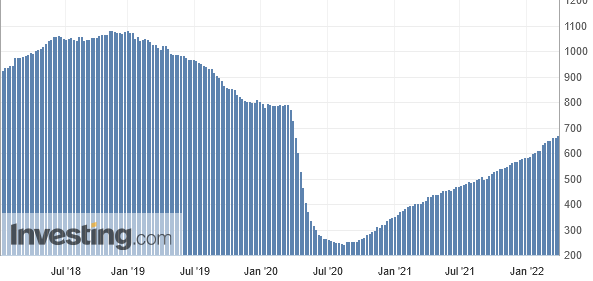

3) US rig count continues to climb.

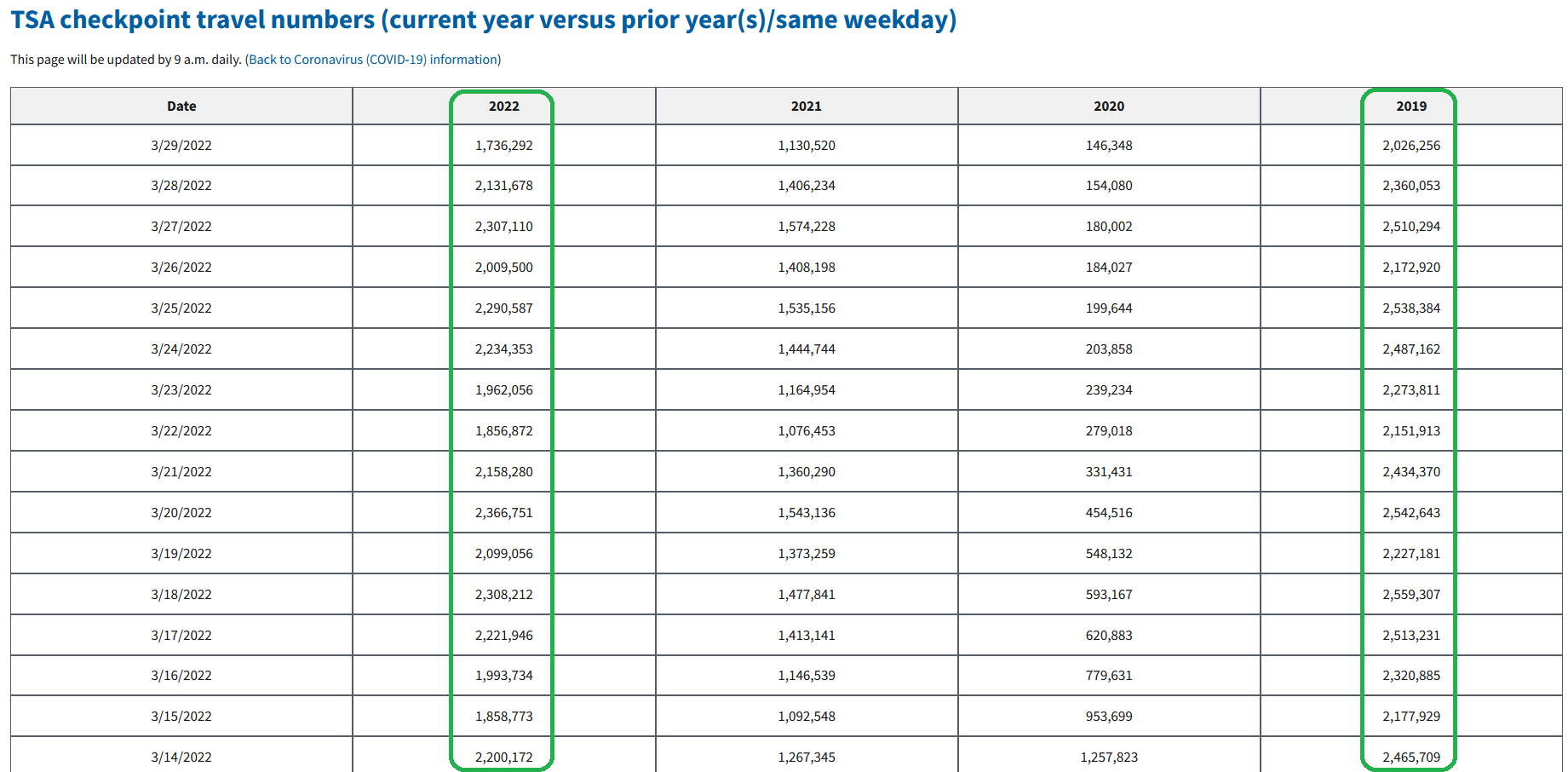

4) Consumers are shifting spending from goods to services (“revenge travel!”) which has alleviated some of the supply chain bottlenecks.

5) Cass Freight Index has rolled over pointing to a drop in inflation for 2H.

6) China is engaged in one of its most aggressive fiscal and monetary EASING periods in years (started in November). The CCP will do whatever is required to juice the economy and stock market prior to the China National Congress transition meeting in November – just as they do every 5 years (the average return of MSCI China in the 12 months leading into the CNC meeting is ~31%).

7) The 2/10 spread has not yet inverted on a closing basis.

8) Once a negotiated settlement is reached with Russia/Ukraine an Iran nuclear deal will be reached with the US. This will put 1-1.8M/bpd back on the market within 6 months.

9) Last month’s jobs report showed average hourly earnings start to come in lower than estimated. We expect that will be the same this Friday. As labor supply comes back online, wages will stop going up so aggressively and cool some of the overheating.