The Fed is now telling us that it can avoid a recession… or engineer a “soft landing.”

It’s a pretty stunning argument… and it raises questions as to whether the Fed actually believes this stuff… of if it’s simply saying this for political purposes so people won’t panic.

Consider what the Fed has done so far in this tightening cycle.

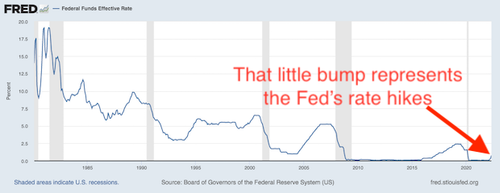

The Fed has raised rates three times bringing them to 1.5%-1.7%. Historically, this is where rates would FALL TO during a market crash or economic downturn. Inflation, as measured by the Consumer Price Index or CPI is over 8%. So rates are extraordinarily low.

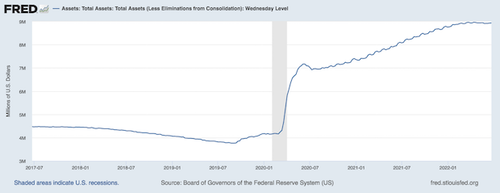

Meanwhile, the Fed has yet to shrink its balance sheet… at all.

That’s correct, despite all its claims of “taking action” and “moving to stop inflation” the Fed has yet to shrink its balance sheet. It’s literally done NOTHING in terms of draining liquidity from the financial system.

In simple terms, the Fed has done next to nothing to stop inflation. Rates are at levels that you would usually associate them to hit during easing cycles and the Fed’s balance sheet is ~$9 trillion.

Meanwhile, stocks and bonds have wiped out over $25 TRILLION in wealth… more than was wiped out during the Great Financial Crisis of 2008 and the pandemic Crash of 2020.

What does this all mean?

That inflation will continue to run hot MUCH longer than anyone expects. The Fed is bluffing when it states it can get inflation under control easily… it’s going to take a LONG time and involve a LOT of pain for anyone who buys into the Fed’s nonsense.