Summary

- The negative supply shocks related to COVID and the Russian invasion of Ukraine are causing headwinds for the US economy, which contracted in the first quarter of this year. However, as consumption and investment remain robust, the US is likely to avoid a recession this year.

- Meanwhile, a wage-price spiral has started that will be difficult to stop without the Fed hiking the economy into recession next year.

- Therefore, a recession seems inevitable: even if the US is able to absorb the exogenous shocks to the supply side of the economy, the response of the central bank to the wage-price spiral will cause a recession from within

Introduction: shocks to the system

Two months ago we concluded that the Fed is going to push the US economy into recession. The FOMC had finally reached the conclusion that it needed to catch up and fight inflation by taking policy rates into restrictive territory. We distinguished between exogenous and endogenous threats to the US economy. In the last two months we have gotten a sharper picture of these threats and their potential timelines. The exogenous threats to the US economy are the negative supply shocks related to Covid-19, including the most recent lockdowns in China, the Russian invasion of Ukraine, and subsequent sanctions. Our European macro strategists expect that the oil boycott announced by the EU last week is likely to push the European economy into recession by the end of 2022/early 2023. These exogenous threats could drag the US economy into recession even before the Fed is done hiking.

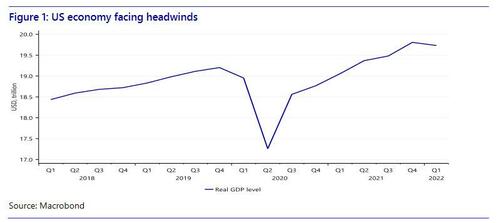

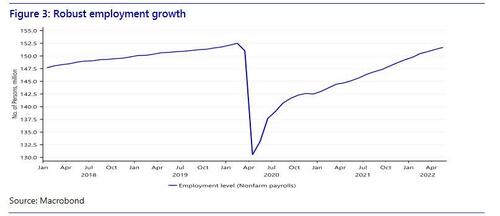

Note that we have already seen a negative US GDP growth figure in 2022 Q1 largely due to a large negative contribution from net exports and slower inventory accumulation. However, consumption and investment growth have remained robust, so a near-term recession will probably to be avoided. In fact, employment growth – a less ambiguous measure of economic activity than GDP – has remained strong.

Terminating the wage-price spiral

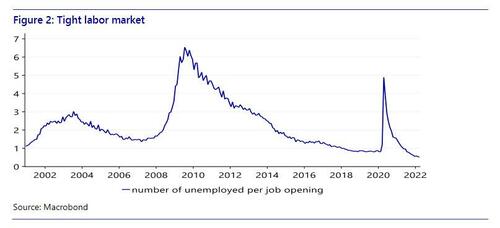

The endogenous threat to the economy is the wage-price spiral that has emerged in the US and the Fed’s mission to get inflation back to the 2% target. The Fed has admitted that it waited too long addressing high inflation. Now it is trying to catch up by taking big rate steps and going into restrictive territory. The Fed thinks that in theory it should be possible to get inflation back to 2% with only a slight rise in unemployment and instead a substantial decline in vacancies, but the probability that the Fed can pull this off is very small. The policy rate is a very blunt instrument to steer the economy and it works with a considerable lag. What’s more, it works through the demand side, while the economy is experiencing a series of negative supply shocks. More importantly, reducing vacancies without increasing unemployment is largely a matter of increasing match efficiency. This requires active labor market policies, such as training and job search support. However, these measures are outside the scope of the Fed and the prerogative of federal, state and local governments. Therefore, in order to break the wage-price spiral and get inflation back to the 2% target, the Fed will likely have to force the economy into recession and push up the unemployment rate substantially.

Another scenario that could help avoid a recession is a rebound in the participation rate that eases wage pressures, reducing the incentive for the Fed to hike into restrictive territory. However, the rebound that many expected last year is still yet to happen, which suggests that a large part of the decline in participation is permanent, as we discussed in Labor shortages: temporary or permanent?

While Powell has tried to explain the route to a soft landing a couple of times, he does not seem to believe it himself. This came to the surface in recent interviews. During a May 12 interview with Marketplace Powell said that “whether we can execute a soft landing or not, it may actually depend of factors that we don’t control”, referring to negative supply shocks. On May 17, Powell gave an interview during the Wall Street Journal’s Future of Everything Festival. He said that the Fed’s resolve in combating inflation should not be questioned, even if it requires pushing up unemployment. He said that it seemed that the unemployment rate consistent with stable inflation is probably well above 3.6%. (Note that unemployment stood at 3.6% in May.) Powell repeated his hope that the Fed can curtail high inflation without spurring a large rise in unemployment. However, he admitted that there is little from modern economic experience to suggest that outcome can be achieved. He said he wasn’t at odds with those who believe the Fed faces a difficult path to a ‘soft landing’, in which growth slows enough to bring down inflation without triggering a recession. Regarding the hiking cycle, Powell said “we need to see inflation coming down in a convincing way. Until we do, we’ll keep going.”

The timing of the recession

Having established that a recession is almost inevitable, we turn to the question of timing. When the recession hits really depends on what will cause it: the exogenous supply shocks or the Fed’s response to the inflation caused by these shocks? The economy is already being hammered by a series of negative supply shocks that could drag down the economy even without the Fed hiking policy rates into restrictive territory. In fact, the US could already be in a recession. After all, GDP growth in Q1 was -1.5%. So if Q2 GDP growth turns out negative as well, we are already in a recession according to macroeconomics textbooks. However, this does not seem very likely given robust consumption and investment. What’s more, in the US recessions are determined by the NBER which tends to focus more on employment growth than GDP. Employment growth has remained strong this year.

Meanwhile, the Russian invasion of Ukraine and subsequent sanctions are likely to push the European economy into recession by the end of 2022/early 2023. While the US economy may be strong enough to grow despite the headwinds from a recession in Europe and a slowdown in China, the Fed has no choice but to engineer a recession if inflation remains persistent. So assuming that the US manages to avoid a recession this year, we expect the Fed to push the economy over the cliff next year. The Fed is expected to reach the neutral rate in the final months of this year and to raise the target range above it early next year. With the usual lags of monetary policy this would likely get the US into recession in the second half of next year.

Conclusion

In the US, a recession seems difficult to avoid. Either the exogenous supply shocks are going to bring down business activity or the Fed’s response to high and persistent inflation is going to do the job. The timing of the recession will depend on whether it is caused by exogenous or endogenous factors. Given the strong labor market and robust consumption and investment at the moment we think that the endogenous will be decisive. This means it is more likely going to be the recession of 2023 rather than the recession of 2022