Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same. They propose to harm the corporations which produce the things we need such as energy and food, which will somehow cause prices to drop. They think that hurting producers will do good for consumers.

Think about this. Take as long as you need.

The Quantity Theory of Money is Dead Wrong

However, there is a more subtle zero-sum view about money. According to the Quantity Theory of Money, a rising money supply causes rising prices, and rising prices are caused exclusively by a rising money supply (I have written extensively about nonmonetary forces driving up prices: mandatory useless ingredients, lockdown whiplash, green energy restrictions, trade war, and tariffs, and actual war in Ukraine. For a complete review of this analysis, download our Gold Outlook Report 2022).

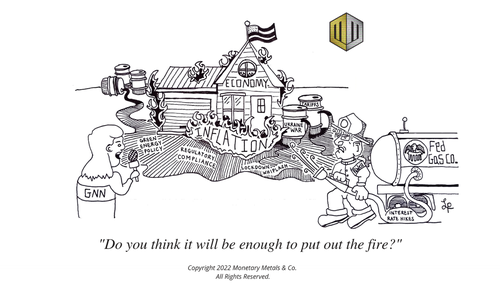

Prices have certainly been on a tear recently. The Consumer Price Index is over 8% for the first time in a very long time. So, what is the Fed to do about it, and what central plan should it impose?

The Quantity Theory holds that to control inflation, the Federal Reserve should reduce the quantity of dollars, or at least reduce the rate of increase. It is supposed to do this by hiking interest rates (it has hiked twice so far this year). At higher interest rates, the theory holds that there should be less new borrowing. Thus, the rate of new money coming into the economy is reduced. And inflation is supposed to be mitigated.

According to this theory, there is a tradeoff between unemployment and inflation. So, in order for consumers to get more for their money, workers need to be laid off.

But less borrowing, of course, means lower production. This logic commits a similar error as the above idea of harming producers. Only, the target here is the workers who produce the goods. To state the contradiction explicitly: fewer workers, producing fewer goods, will cause lower prices.