Critical information for the U.S. trading day

Investors are trying to regroup following the worst month since the pandemic, and Friday’s session that ended with the Dow tanking nearly 1,000 points and the S&p 500 pushing back into correction territory.

All eyes are on this week’s monumental Fed meeting, where a 50 basis-point rate hike is on the cards — some say April’s meltdown means don’t expect anything bigger.

Unicredit’s chief economic advisor Erik F. Nielsen told clients that despite a dismal April, stocks are holding up better than he expected, but maybe not for much longer: “The problem is that asset allocation is always the result of a probability game, but as the odds change with a deteriorating world economy, cash and other zero-yielding holdings might well become more attractive as a parking place for a while.”

Onto our call of the day, which comes from Bill Gurley, general partner at Benchmark Capital and a venture capitalist who made an $11 million bet on Uber UBER in 2011. Several of his more than a half-million followers on Twitter sat bolt upright after this Twitter thread:

“An entire generation of entrepreneurs & tech investors build their entire perspectives on valuations during the second half of a 13-year amazing bull run. The ‘unlearning’ process could be painful, surprising, and & unsettling to many. I anticipate denial,” tweets Hurley, who adds three points to this:

- Previous ‘all-time’ highs are completely irrelevant. It’s not ‘cheap’ because it is down 70%. Forget those prices happened.

- Valuation multiples are always a hack proxy. Dangerous to use. If you insist, 10X should be considered AMAZING and an upper limit. Over that silly.

- You may be shocked to learn that people want to value your company on FCF [free cash flow] and earnings. Facebook trades at 14X GAAP & is growing 23%. What earnings multiples are you assuming?

- Revenue & earnings QUALITY matter.

Gurley linked to his blog from 2011, where he explained that discounted cash flows “are the true drivers of value for any financial asset, companies included,” and that price/revenue is a “dangerous technique because all revenues are not created equal.”

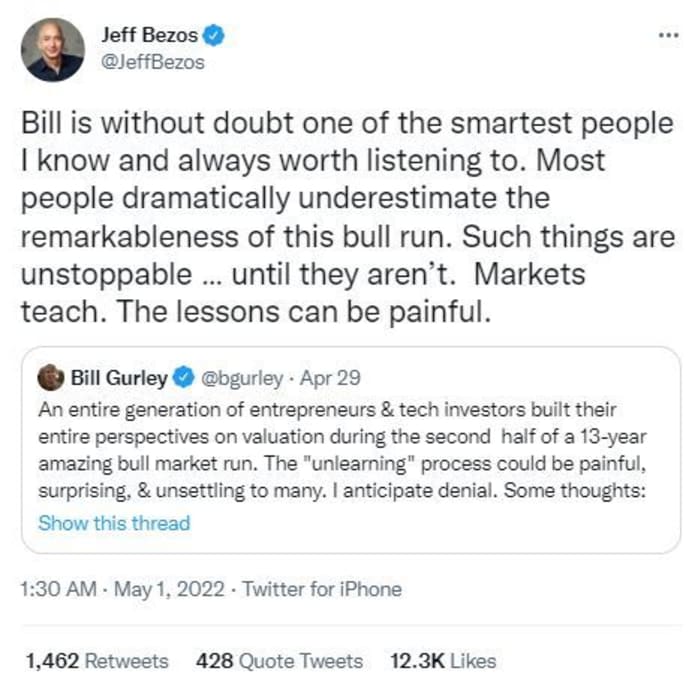

Among those reacting to Gurley was Amazon AMZN CEO Jeff Bezos, whose stock is facing its worst year since 2008, after the company’s first loss in seven years:

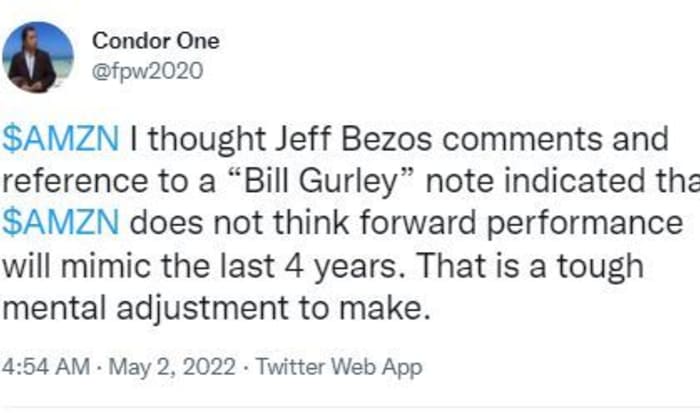

To some, Gurley’s comments were a warning of tough times to come for the tech sector:

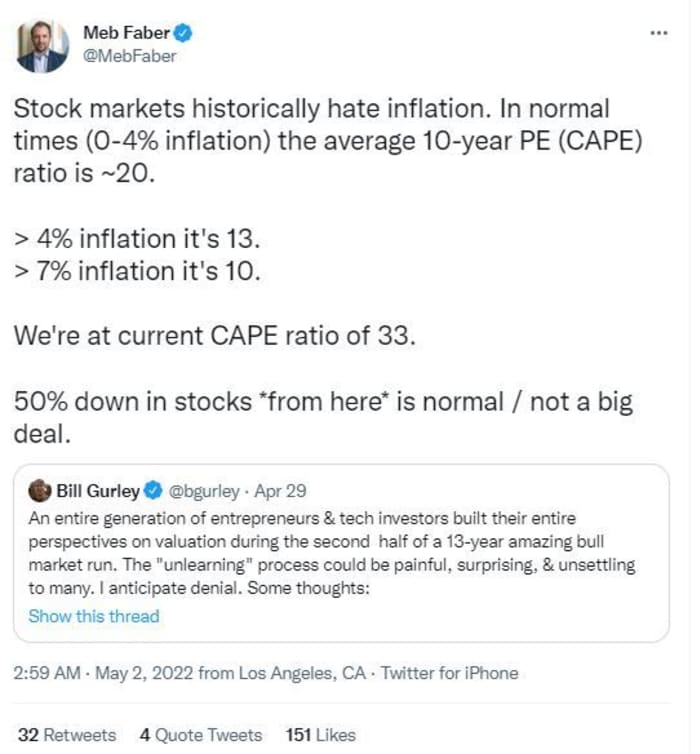

On the flip side, others say big stock drops in the current inflation environment aren’t abnormal: