S&P:

Important Stanely Druckenmiller Quotes (he’s the best):

“Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

“The first thing I heard when I got in the business, not from my mentor, was bulls make money, bears make money, and pigs get slaughtered. I’m here to tell you I was a pig. And I strongly believe the only way to make long-term returns in our business that are superior is by being a pig. I think diversification and all the stuff they’re teaching at business school today is probably the most misguided concept everywhere. And if you look at all the great investors that are as different as Warren Buffett, Carl Icahn, Ken Langone, they tend to be very, very concentrated bets.”

MacroOps had a nice write up last week on Druckenmiller.

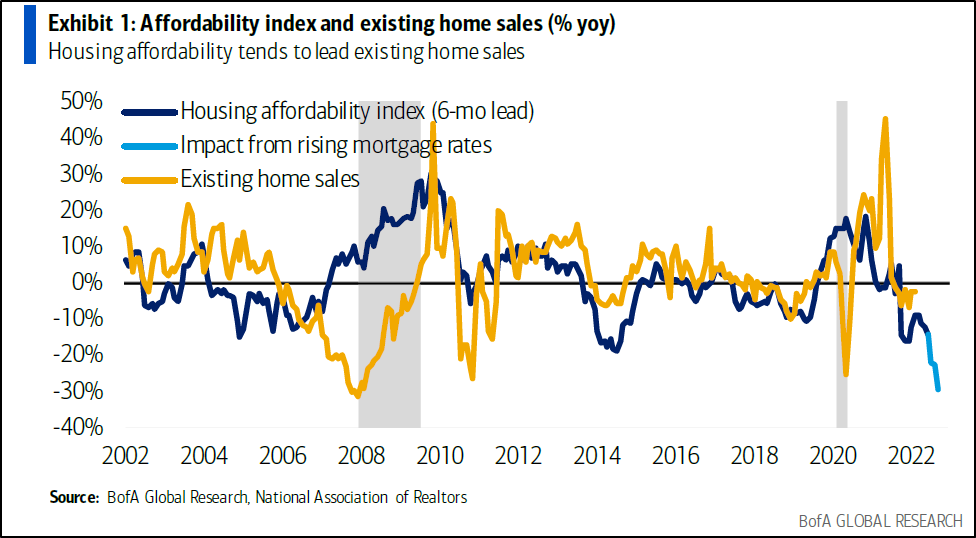

The housing market will drastically cool down. Notice the leading indicators hurting below (HD, KBH).

Food for thought: The vast majority of statistics that you see quoted are useless and are just a narrative. Follow price action. (SBF is the smartest around).

Keeping This Important Bitcoin Chart Here.

Return always wants its risk payment. Not Investment Advice.