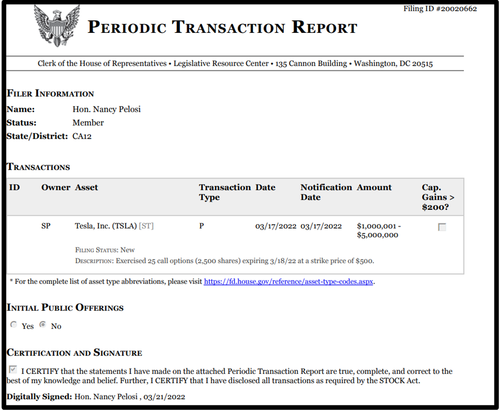

It was reported today that Mr. Paul Pelosi, husband to Nancy Pelosi, House Speaker, exercised options securing between $1 million and $5 million dollars worth of Tesla stock on March 17th, days after the Infrastructure Investment and Jobs Act was applauded by his wife Nancy, the House Speaker on March 14th.

Paul Pelosi Bought Tesla Calls in December 2020

In January 2021, Zerohedge posted a story dissecting a call buying spree Paul Pelosi went on in December 2020.

Paul Pelosi purchased LEAPS in Tesla, Apple and Disney and shares in AllianceBernstein on December 22, the disclosure revealed. In other words, it’s not just clueless retail Robinhood investors that are speculating; it’s also clueless politicians.

Paul Pelosi can afford to be clueless because he has a wife that lobbies for billions of dollars in subsidies for that very industry to which Tesla belongs.

Nancy Pelosi Delivers Subsidies for EV Charging Stations

In that story: entitled Nancy And Paul Pelosi Bought More Than $1 Million In Tesla…In December they also stated:

Obviously, the call option purchases are worth noting – not only because they are leveraged investments and are far more risky than buying outright stock – but because the Speaker now clearly has a vested interest in the success of names like Tesla, whose trajectories as public companies can be altered drastically by government decisions.

Worth noting indeed. Nancy Pelosi since that “risky investment” was placed, spearheaded legislation to give tens of billions of dollars to build electric charging stations across the country.

The bill announced on March 14th will deliver for New York alone the following charging station subsidies:

“Under the Infrastructure Investment and Jobs Act, New York would expect to receive $175 million over five years to support the expansion of an EV charging network in the state3 . New York will also have the opportunity to apply for the $2.5 billion in grant funding dedicated to EV charging in the bill. “- Whitehouse Source

How Was theTrade Risky?

In December, Pelosi bought 25 in the money Tesla calls, selecting the $500 strike calls with a March 2022 expiration. The 25 options represent 2500 shares of Tesla upon exercise. Why in the money? Glad you asked.

The options were already in the money when purchased. You do this when you feel you have close to a sure thing. This also gives the buyer almost complete exposure to a rally in the stock without the public stigma of owning it. The only real difference is voting rights. Let’s face it, his wife has more influence in the House than he would have voting.

When you are unsure, you take less actual stock risk and use more leverage by buying out-of-the-money options. When you are much more sure, you risk more money by buying in the money options. Simply put, you bet on the horse as it nears the finish line. The payoff amount is less leveraged, but the odds are stacked in your favor more. The leverage is actually less, the payoff chance is a higher probability.

Last week, Paul cashed in on the options by exercising for between $1 million and $5 million worth of Tesla stock days after the speaker’s public appearance in Brooklyn New York on the Infrastructure Investment and Jobs Act’s passing. We see no evidence he sold the shares out afterward. The trade also came while pressure to ban Congress members and their significant others trading stocks of companies. Pelosi herself endorsed the bipartisan ban bill (reluctantly) last month that lawmakers drew up to stop potential insider trading from happening any more. Republicans alleged that Pelosi was cashing in on her position of power. But that didn’t stop Paul from exercising his calls

Tesla Options Exercised

Specifically, Mr. Pelosi exercised options to buy between $1 million and $5 million in shares on March 17, according to disclosures filed with the House clerk. He purchased said options on Dec. 22, 2020, as stated above, for an approximate cost of $500,000 to $1,000,000 all in. These options purchased were exercised just days after the event in New York City where the EV industry in general, and Tesla, in particular, reaped giant subsidies.

Not only did he exercise them as they were expiring, he actually didn’t sell the stock after the spike to $1240 last year… Maybe someone should tell him about delta hedging and swing trading. Come to think of it, he is clueless. Which makes it even more repulsive. Lack of ability does not mean lack of success when you are married to the Speaker of the House.

Counting The Pelosi Lentils

Tesla’s stock price has increased dramatically since Paul Pelosi purchased the options, from $640 on Dec. 22, 2020, to $871 as of March 17. His net profit would be the price difference of $231 minus the time value of the option. All told around half a million dollars for 25 options. His “sure thing” came in. Assume the Pelosis are still long and have even more money to count. That puts another $220 per share in their pockets. That buys a lot of lentils.

That’s another reason you pick in-the-money calls. While they have more delta risk, they have much less time value. When you are right, your profits are greater for both of those reasons. No bank lets clients use that kind of risk unless they had the money for a margin call. Calling it leverage is deceptive. Leverage is greater on out-of-the-money options. Better to call it a guaranteed under-the-radar winner. Pros seeking exposure but not too much time value risk trade slightly in the money options. Long shots are for suckers.

Pelosi’s office did not respond to a request for comment.