As of this writing, the dollar is up 43 bps. Bonds are softer. Stocks started the day mixed, but are significantly lower now. The Nasdaq is down 2.8% at the worst of it. Gold is also weak, down $17, and silver which started the day strong is also down. Oil continues to defy gravity up another $1.80. Grains and crypto are also down.

Today’s sell-off started after the NFP number came in slightly stronger than expected, but continued big gains of 390,000 people were added to payrolls. Musk’s comment about laying people off and Dimon’s “hurricane” comment probably did not help either. It also seems the more Biden talks about what he is doing to help fight inflation, the worse it is for stocks. There is, we sense, a growing unease even in the equity markets with half-cocked statements designed to calm voters that are really unnerving investors.

Politically Expedient

From Biden Pursuing The Quickest And Least Effective Way To Fight Inflation:

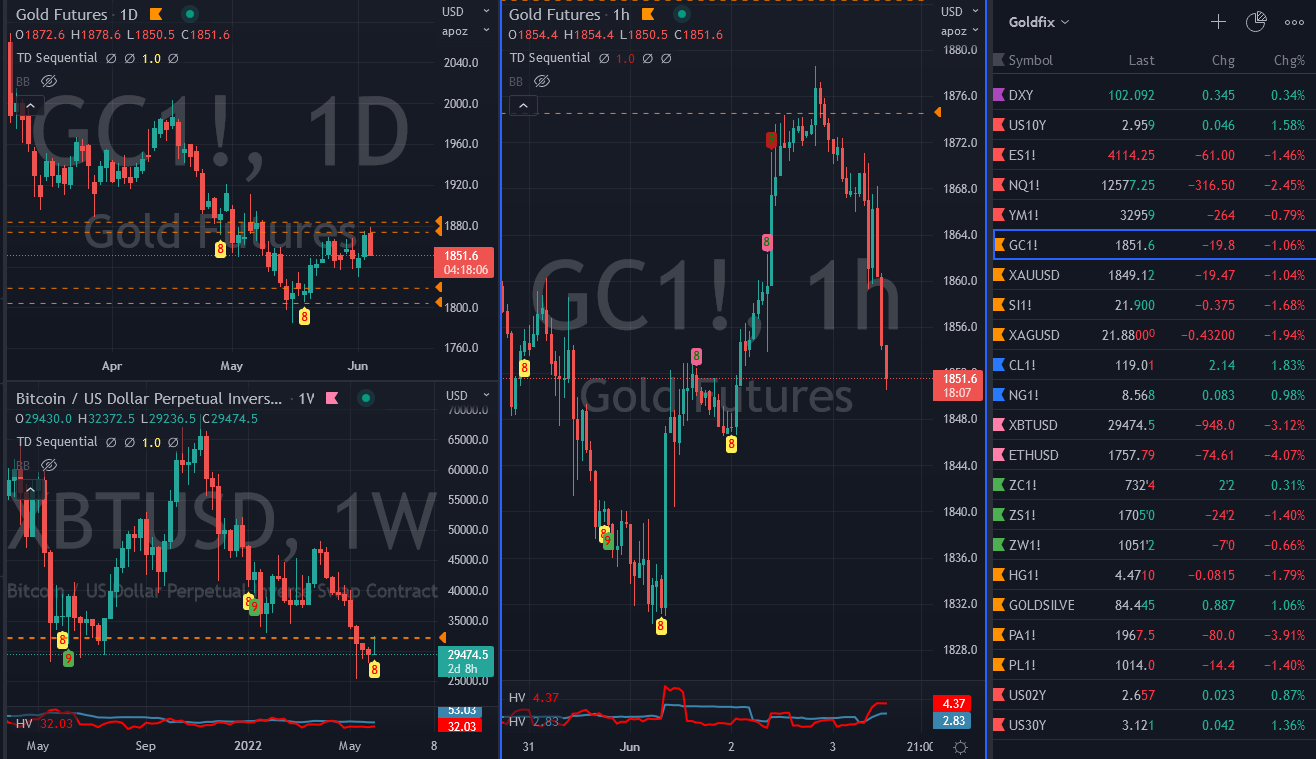

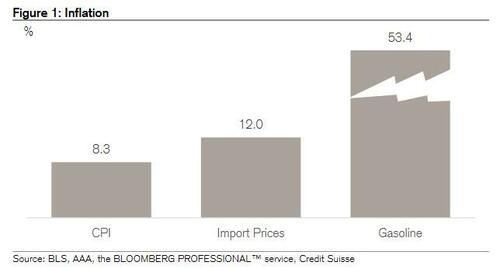

Over the past year, CPI has risen 8%, import prices 12%, and gasoline 53%, and as popular outrage has exploded, it is not surprising that governments around the world and certainly the United States, are enacting policies to “mitigate” inflation and alleviate the burden of higher prices on low- income families.

There is just one problem: as Credit Suisse strategist Jonathan Golub writes, most if not all of these policy prescriptions lower near-term prices but leave longer-run inflationary pressures in place. While politically expedient, these efforts encourage additional spending, like what the Biden administration is pursuing right now. They also undermine decision-making by obfuscating price signals.

One California Representative’s Horrible Idea

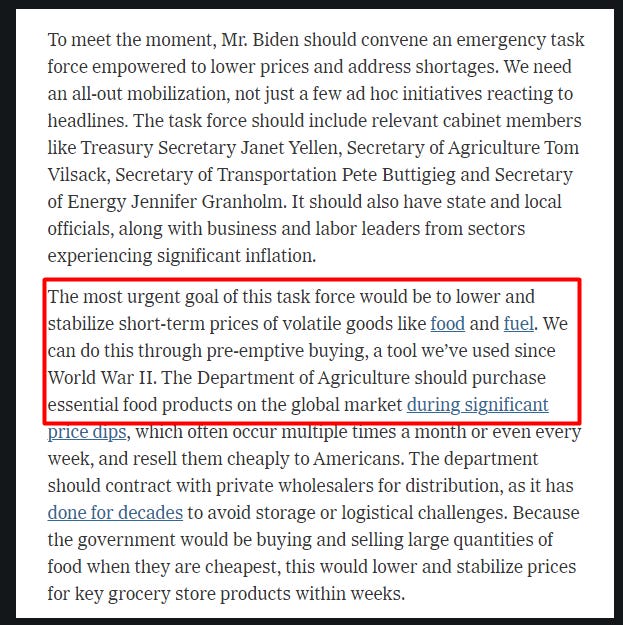

The New York Times had its own take on how to cap inflation. By letting the government just buy the goods and then sell them back at a discount to the public. For example, A new “emergency inflation plan” proposes the government go out and buy food and energy and resell them at a discount to people to keep prices down. This is frankly, insane to do, and worse to say you are doing it out loud.

The article laughably suggests the same approach to energy:

Similarly, the Department of Energy should buy petroleum on the global market during price dips to resell it more cheaply to Americans during subsequent spikes. It may not feel like it now, but the price of fuel does dip. The department should do this for all essential fuels, including home heating oil and natural gas through the Strategic Petroleum Reserve. The S.P.R. legislation places no quantitative limits on the authority of Mr. Biden or Secretary Granholm to sell from the reserve in response to declared energy supply disruptions or to replenish supplies. We can go orders of magnitude beyond the president’s current sale of one million barrels per day, which amounts to only 5 percent of current daily use and still helped lower prices by 4 to 5 percent.

If you want to read the rest of this pandering politically expedient idea, go here- NYT Opinion Source

Imagine the richest guy in the world telling you he wants to buy a purple crayon. Then imagine him saying, no matter what price he buys it at, he will sell it cheaper to the public to help them. What happens?

Purple crayon prices explode. He buys the crayons at the market price, resells them to the public at a loss, and then announces he saved the public money. This is horrendous. The principles of subsidy, price caps, and even QE are all combined into a dangerous proposition that impoverishes the nation at the highest and lowest levels. You may as well go out and buy commodity stocks and the banks that will finance the deals.

We can only hope it is a trial balloon that gets shot down immediately. If that is still legal.

Excerpts

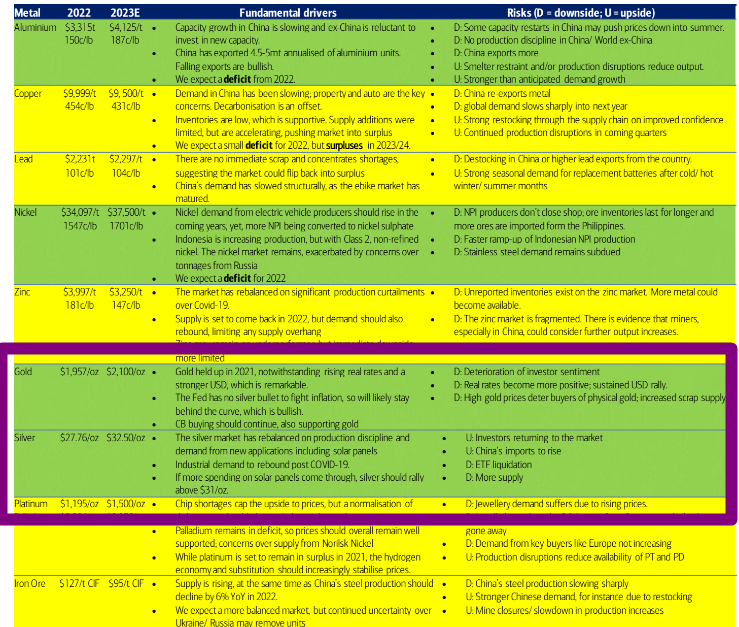

BOA on Copper short squeeze risk:

While not necessarily about Gold or Silver today, this is very informative on how one would happen in Copper, Aluminum, and eventually Silver by proxy.

Low on-warrant stocks + speculative length = squeeze risk Over the last couple of years, commodity markets have been very volatile. This was driven by a confluence of factors, including the Covid-19 pandemic and, more recently, the war in Ukraine. In particular, Russia’s attack on its neighbouring country has contributed to a violent nickel squeeze.

Looking beyond some of these idiosyncratic factors, we have run correlation and PCA analyses to determine which market metrics would have signalled the risk of violent short squeezes.

TS Lombard on the Economic Hurricane

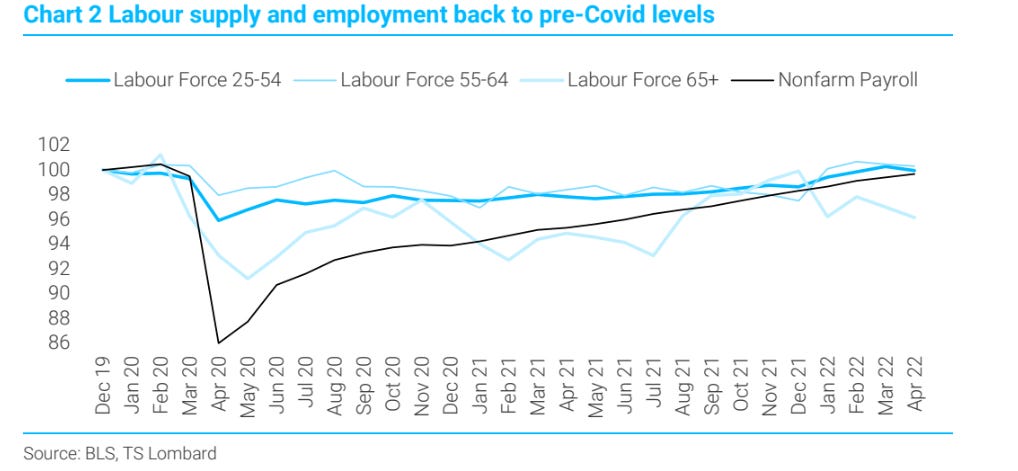

The Fed, however, continues to push the false narrative of lost labor supply as the reason for large wage hikes–because it absolves them of being the cause

The two main reasons why wage growth is soaring are strong labor demand(including the mix/shift in employment towards skill–the hire-quit spread for manufacturing is above its pre-Covid median, it is below for leisure and hospitality)plus persistent shocks to inflation that counter the transitory argument. The labor force aged 25-to-54 is 99.96% of December 2019 levels, and total nonfarm payrolls are at 99.69%. The 55-to-64 age group is 100.3% of pre-Covid levels and the over 65 group, the big fall-off, is 96.2% (Chart 2). If the employment/population ratio was used instead, it would show the same result–with the big falloff in the over 65 crowds. It is a huge stretch, to say the least, to believe that the nation needs 70-year-olds to return to work to temper overall wage growth.

Why we like TS Lombard. Their client base is European but they write about the US a lot. This makes it easier for them to be frank with readers about our economy. They do have strong opinions; and while we don’t always agree with them, they make some points that you would not hear from a US bank.