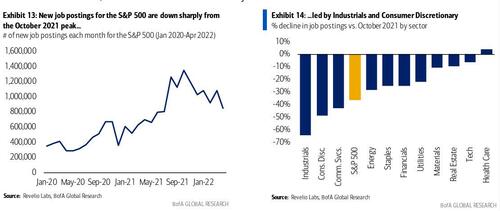

Just days after we reported that “Real-Time Indicators Show The Labor Market Just Cratered“, suggesting that the last pillar propping up the US economy (with GDP now just 0.9% away from a full-blown technical recession) was about to crack…

… the BLS reported that May payrolls actually came in stronger than expected, largely thanks to very generous seasonal adjustments and more than one political tap on the shoulder. This prompted many to ask what is going on: are real-time indicators flawed and is the black-box model that is the BLS’s politicized, subjective, often flawed methodology the correct one?

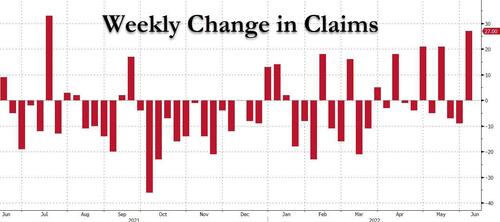

Moments ago we got a strong hint about which way “reality” lies when we got the latest jobless claims report and it confirmed that indeed, the jobs market is cracking, with initial claims jumping from 203K to 229K…

… which was the biggest jump in claims since last July…

… the latest troubling confirmation that the best days for the US jobs market are now behind us and that the BLS has a tough uphill climb as it seeks to represent the monthly payrolls data correctly. We are confident they will get it done in time for the Jackson Hole symposium, around the time the US will officially slide into a recession.

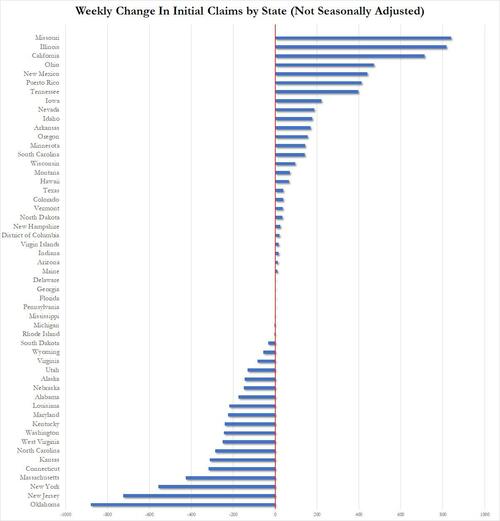

The breakdown by state did not show any notable outliers, with Missouri seeing the biggest increase in claims and Oklahoma, having the biggest decline.

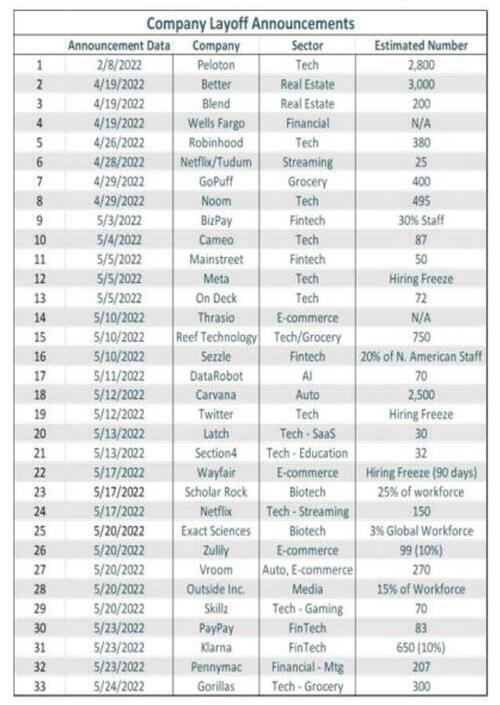

That said, even though the labor market has peaked, there is clearly still a ways to go before the US jobs market is in freefall – the bogey that the Fed needs to see before it halts its tightening – although now that weakness is starting to set in, keep a close eye on more reports of corporate mass layoffs.

Enough of those, and even the BLS will have to admit that the final pillar propping up the US economy has just turned red.