Why Gas Panic Could Be Worse Than Toilet Paper Panic

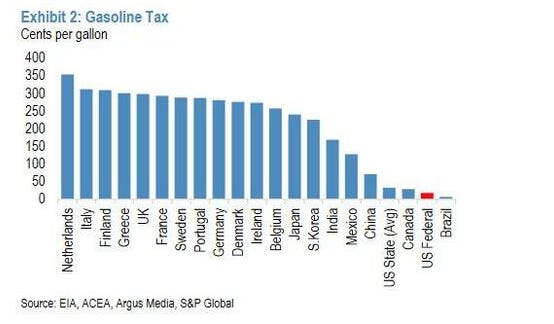

Yesterday, The Biden White House released a fact-sheet outlining its call for a 3- month moratorium on the 18 cent Federal Gasoline tax at the pump. This amounts to approximately a 3.7% price reduction as of today. The administration also urged individual states to follow their lead and suspend their own taxes for the same time period.

Finally, President Biden called on Congress to suspend the 24 cents/gallon diesel tax for 3 months.

- It shouldn’t pass.

- If it does it will be very bad for the country 6 months later.

- And they are also looking at a Gas card which is a precursor to MMT/CBDC

Goldman Sachs: Not Likely To Happen

In an Economics report put out late yesterday, Goldman Sachs stated they do not expect many states to suspend their own taxes even if , and that is a big if, Congress votes to ratify the Federal tax holiday. In fact, they handicap the chances of it happening at all as less than 50%.

This is what it looks like when the Federal reserve is trying to lower demand driven inflation while the White House is stoking demand with stimulus…

They then go on to enumerate five main points in a 2 page report to clients that does little to contradict the JPM comment released yesterday. First a quick recap of that JPM report.

JPMorgan: No Way

According to a JPMorgan analyst, the Biden’s admin’s intervention to artificially lower gasoline prices would remove some of the incentive to curb consumption and would in fact push pump prices higher as artificially lower prices would encourage people to drive more.

From Biden’s “Gas Tax Holiday” Would Actually Push Pump Prices Higher

The latest measure under consideration is a temporary halt in the federal gas tax—a key source of funding for federal roads and bridges—that could lower prices at the pump by 18.4 cents per gallon (the 18.4 cents per gallon comes from 18.3 cents in excise tax plus 0.1 cent in a storage fee)….

How much would the tax holiday benefit an average American driver? If the federal gas tax was suspended for the rest of the summer, someone who drives 12,000 miles a year in a car that averages 22.8 miles per gallon would only save about $20.- Source

To our eyes, The $20 savings is ridiculous and even funnier considering what the President was originally asking for, a $400.00 gas card. That’s a big spread from $400 to $20. Considering we may actually run out of Diesel for trucking (supply chains) in certain parts of the country it does not make any sense at all.

We can run out of Diesel this year depending on your location..

The President’s Actual Ask

Factually, President Biden called on Congress to suspend the $0.18 per gallon federal tax on gasoline. He further requested the 24 cent per gallon tax on diesel also be suspended. Finally he called on individual states to suspend their own gasoline taxes. The state taxes average about 26 cents per gallon.

Partisan politics aside, it is almost a guaranteed losing idea. Even worse than the SPR releases done. It is, in our opinion a joke.

Exactly how much of the suspended 18 cent federal gasoline tax would pass through to the pump is not clear. But using the previous state level tax holidays as a guide we can assume that less would be passed along. Further, as time wears on with the suspension still in effect , the chances of price-creep higher to where gas was prior to the tax suspension would be likely. Why less of a pass-through? The reasons are manifold, but the main ones are inelasticity related.

Inelastic Demand Meets Inelastic Supply

Using data from previous state sponsored holidays Goldman explains it feels the Federal discounts would be somewhat less than the 18 cents promised if they passed and shrink even more as time wore on.

First off, refiners are at 94% and higher of refining capacity. That gives them little spare capacity (mostly inelastic supply) in the face of what almost certainly will be higher demand in a largely in-elastic demand commodity.

Further, using past individual state tax-holidays as a metric for the whole country doing it simultaneously runs into more hidden risks. Goldman puts it like this:

While demand for gasoline is relatively inelastic compared with other goods, supply is inelastic as well in light of limited spare refining capacity, suggesting that it was likely easier for refiners to accommodate increased demand in a few states cutting gas taxes than it would be at the national level

They are all but saying the following as only Goldman does: There will be short squeezes, steeper backwardation, and Goldman will profit from it.1 They are also all but calling Gasoline a Giffen good, which it is.

Gasoline Panic Could Be Worse Than Toilet Paper Panic

The quote above is a recipe for a Giffen Good panic. Giffen goods are rare forms of inferior (non-luxury) goods that have no readily available substitute or alternative, such as bread, rice, and potatoes. As many know, Giffen goods violate the laws of supply and demand. As the price of a Giffen good increases, so does the demand. Why? Because not only are they not easily substituted for, they are frequently staples of day to day living.

Puffs are softer than Charmin, just saying…

Remember the toilet paper panic during Covid? Toilet paper is not a Giffen good. You cannot substitute Propane for Premium like you can substitute Kleenex for Charmin. Gasoline can be much worse. Also: Gasoline has a shelf life of about 3 months. Toilet paper demand, once satiated by lunatic hoarders, remains that way much longer. Demand doesn’t stop in a Giffen Good.

How a Tax Holiday Could Play Out

We’re looking at a rolling short squeeze here if the Fed backs off of its rate hikes too soon. So they’d better forget about a Gas Tax Holiday if they have half a brain. That remains to be seen.

For our part we feel the following: While it is unlikely to be a cabbage patch panic in the beginning, it is extremely likely that demand will actually drop right before the tax is enacted, ramp up when it is enacted, and drive prices higher organically from that demand spike. That is even before Goldman’s price-creep takes effect.

This can create even more supply chain issues as refiners can only make so much and gas stations can only hold so much. Physicality matters. The limitations of reality matter a lot when it comes to fuels. Back to the report.

Goldman: Less Than 50/50 Shot and Worse

The Bank’s third point casts doubt on it happening now and even more doubt later.

Congressional action is unlikely before the upcoming 4th of July recess, in our view. After that, we think the odds are less than even that Congress votes to suspend the tax.

According to their recon, many Republican lawmakers and even some Democrats have already voiced skepticism on the idea. But the chance of it happening are not near zero either. The tax suspension idea can possibly be shoehorned into another bill the Dems are currently negotiating in the Senate.

At the state level, some may suspend their taxes, but not many. Budgets are now finalized in most states already. From the report:

Unlike the federal tax, which can be offset through increased borrowing, states rely on gas taxes to finance spending and would likely need to make more substantial changes to their budgets to offset a tax suspension.

States need that revenue for already budgeted forward expenses.

Which States Will Lower Taxes?

So, which states are likely to enact a tax suspension? To start off, many states had already done feasibility studies recently and passed on the idea as not responsible. So which states are likely to do so?

To date, four states have suspended their gas taxes: Connecticut (25 cents/gallon), Georgia (29 cents/gallon), Maryland (36 cents/gallon), and New York (16 cents/gallon). Florida enacted a gas tax suspension earlier this year, but this does not take effect until October 1.

Strictly speaking, one would think a Democrat run state is more likely to rebate taxes at the pump than a Republican state. Sales taxes are regressive by nature and lend themselves to Blue states with more Democrat voters. Further, those Blue states frequently have lower regressive sales tax to begin with and higher progressive taxes (high income tax) instead. The problem is, nothing is “strictly speaking” anymore. Red States are just as likely to, if not more likely to do a tax holiday than Blue states.

Blue States Tax More, Red States Grab Votes

Connecticut for example is a low income tax and high sales tax (Red) state, yet it has done this before. Meanwhile, New Jersey, home of high income tax and low sales tax (Blue state), has not given a tax holiday. Why? Because those in Dem states are in power for good and probably don’t have to do anything.

Those in GOP type states are looking to score points with voters. Anyway, the money rarely gets to where it is needed. Because of political games those who need the relief do not get it. Those that couldn’t care less do. Surprise!

“It’s an Ineffective Stunt”

Mitch McConnell released a statement about Biden’s proposal, which read in part:

“The Biden Administration announced another ineffective stunt to mask the effects of Democrats’ war on affordable American energy

If the chances are less than 50/50, and we assume that White House people are not pea-brained lizards and actually understand the potential risk (they either do not understand or do not care) of this idea; Why try to do it? Politics of course. Goldman won’t touch this rail understandably, so we will. The point of this tax holiday exercise is it is a win/win politically for the Dems.

Prisoner’s Dilemma, But You are the Prisoner…

In the attempt to motivate the voting base and to remind Democrat voters who is in their corner, the leadership has likely calculated that if the proposed moratorium passes, then their leaders have delivered. If it doesn’t pass; they flip the script to say they tried, and the GOP is to blame for blocking it. There is nothing new here to see; just lifetime politicians mortgaging your future for their job security. They should all stand in front of windmills and blow to generate our green energy. But we digress.

Senator, your mouthwash ain’t making it…

Gas Card as Precursor to Digital Dollar

The media had recently reported the White House was looking into floating a $400 Gas Rebate Card for households. This was notably absent from the proposal.

Goldman says “The announcement is also interesting for what it omits. Recent media reports indicated the White House was considering proposing a $400 gas rebate card for households, though this never seemed likely and it seems less likely with today’s proposal.”

We think this idea as well as other ideas were omitted because they just knew it would not fly. But consider this: If gas prices remain firm, and the Republicans are ready to permit a tax holiday in a few months time, the Biden administration could pull a bait-and-switch and insist on a gas card to help people. This concept is exactly what the government is moving towards. Specifically we are talking about digital dollars.

Gas Holiday as Digital Trojan Horse

Central Bank Digital Currency (CBDC) will do the same thing as a gas (or food, or rent) card when it comes. Money will be given to spend on food, not cigarettes etc. Digital food stamps if you will or the next iteration of EBT cards.

None of this is evil in itself mind you. The ability to direct spending and aid those most in need would be a much needed scalpel in a world of monetary chainsaws. The abuse2 however would be legendary. But we will visit that another time. Suffice to say, Gas Cards or some other targeted stimulus will make another appearance. And it will be followed by the introduction of CBDC.

Bottom Line is you will pay now, or you will pay later, but pay you will. Compliments of ESG hype and poor planning.