Something’s Gotta Give at the Fed

TL/DR

“Inflation has to stabilize higher than 2%, unemployment must baseline above 5%, or GDP must go significantly lower. Something has to give.”

Questions were asked about the rationale for several recent posts and opinions. Here are the top 3 of those answered in conjunction with a little context.

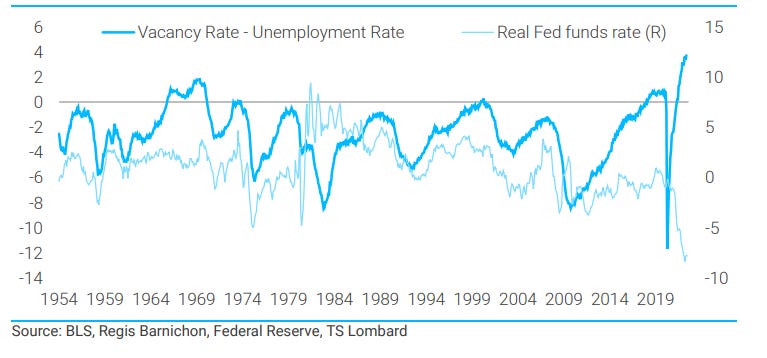

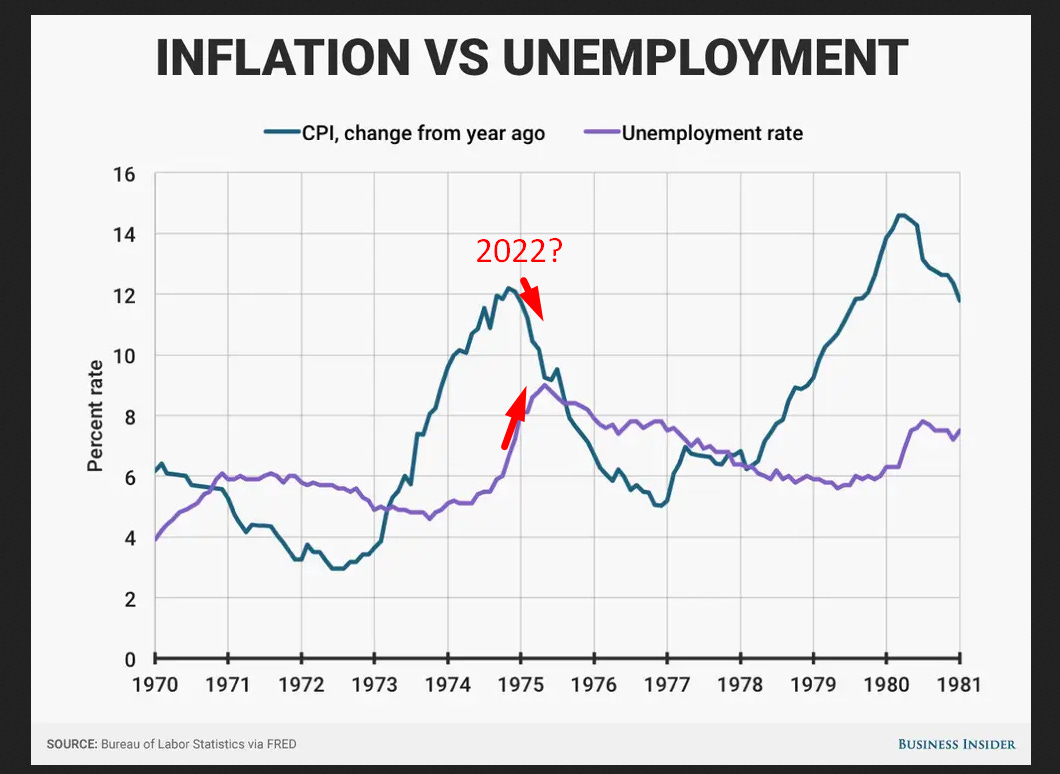

Question 1: Can the Fed drive the real fund’s rate high enough and keep it there long enough (to kill inflation) while keeping unemployment under 5%?

- Yes.

Question 2: Do they have the political will to do it?

- No. Not yet.

- Given the political pressures of wealth redistribution via the “inclusive” mandate and the current administration’s progressive pressures, there is almost no way the Fed has the political will or permission to do that.

- This can very likely end in a Nixon/Burns type of Fed diad where socioeconomic pressures, changing attitudes, Geo-political pressures, and more conspire to make it impossible for the Fed to do this even if they wanted to. (See below)

Question 3: If they do it anyway, can they do so without causing a much bigger recession than we are currently experiencing?

- Probably not.

- And especially not without goods inflation substantially down; which happens only without war, sanctions, and East/West animosity.

- It is almost impossible to get inflation back down to an acceptable level without causing a worse GDP drop all the while keeping unemployment1 near its recent average even with job openings dropping substantially from current levels. (See below)

On Having The Political Will to Do It:

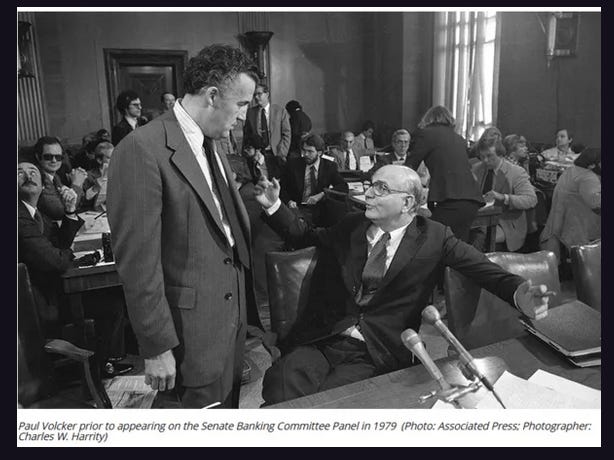

Checklist from former Fed Chief Dr. Arthur Burns’ lecture on why the Fed did not do the right thing between 1970 and 1978.

Volcker moved aggressively after he heard Burns’ lecture…

- Philosophical and political changes

- The desire for a more interventionist govt

- Unevenly spread prosperity

- Substantial societal tensions

- Reflexive embedded societal expectations

- Overwhelming goal of full employment

- Environmental policies added to the inflation

- Entitlements diminished the work ethic

- Fed had tools to stop the inflation but chose not to use them because it had been caught up in the social movements of the day

- Fed is beholden to Congress, how could it stand in the way of societal changes that Congress was attempting to enact

- Understand what the appropriate level of “full employment” was

- Central Banks can’t stop politically driven inflation. They have the tools, but not the will

- Inflation was fed by high unemployment, deficits, money creation

What has changed since then? Nothing in our view. Full lecture context of these here

On Causing a Much Bigger Recession If They Do It

TS Lombard on the current predicament and higher normal inflation and/or unemployment needed to rebalance the economic table (emphasis ours):

The notion that inflation magically falls back to 2% without disrupting labour markets is a fairy tale whose belief, when exercised in policy, translates into inflation during the [ next] recovery that follows the coming [current] recession that will be higher than what the economy experienced in the 2010-19 expansion. This is not a policy bias that ends well

What will happen at the top level?

Calculations and definitions will be changed, political pleading will commence, bureaucrats will be replaced, lectures will be given to “take our medicine”, tough love lectures, and all the knobs used to keep the economic data in an acceptable range will be twisted to make it seem ok.

What will happen in reality?

But the real economy will get destroyed/reset by economic forces that cannot be massaged away as statistics can be. A generation of small business owners and working-class families will see taxes go up while loopholes for the rich evolve and the poor need even more help than in the past.

Conclusion:

2% inflation is a fantasy given these parameters. The noninflationary unemployment rate is now well above 3.5%. That relationship was broken through the use of QE2. It was kept on life support from Goldilocks tailwinds and tactics like REPOs, RRP, YCC, Fed “guidance”, with Vol and Gold selling. But the jig is up.

Either inflation normalizes at a significantly higher baseline, unemployment normalizes as being “full employment” closer to 5 or 6%, or we get a torrid stagflationary recession worse3 than the 1970s as the market resets itself on the backs of its citizens while leaders continue to delude themselves that all is well. One or more of the 3 legs that hold up our economic table has to be significantly reset to retain economic balance.

Inflation has to stabilize higher, unemployment must baseline above 5%, or GDP must go significantly lower (recession worse). Something has to give.

What saves us from this:

The long term will be fine if you are currently 4 years old. The US will re-establish itself in manufacturing and also re-domesticate its supply chains. Instead of cars, we will lead the world in chip manufacturing.

Short term what makes this analysis wrong is if the war ends, sanctions are lifted, the BRICs do not create an alternative monetary system, and the East and West heal. All that can happen, and probably will in degrees. But we need the degrees to be big enough to reverse the effects of growing global fragmentation. That we think is too late. Buckle up