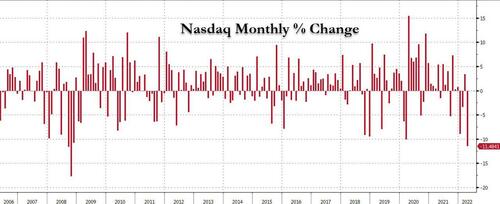

Earlier today we observed that the Nasdaq was on pace for the worst month since 2008, and judging by the ongoing collapse in the tech index which is now down more than 2%, and trading reading near session lows ahead of today’s margin calls that’s pretty much assured.

But thanks to Deutsche Bank we have stumbled into an even more remarkable state.

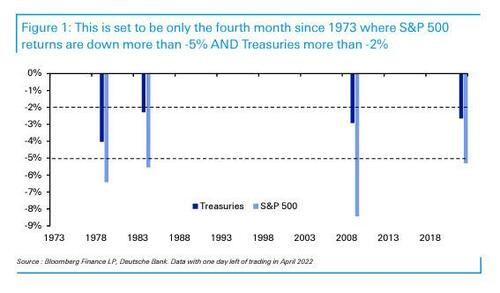

As the bank’s head of thematic research Jim Reid writes, and sparing us the obvious TS Eliot references, today is the last business day of the month and we could see something in April we’ve only seen three other times since our data starts in 1973: a month where S&P 500 returns fall more than -5% AND US Treasuries fall more than -2%.

At the time Jim wrote his note a few hours ago, the S&P was down -5.3%, and TSYs was -2.6% in total return terms. Since then it’s only gotten worse, a move which shows how profound are the disconnects in the market at the moment.

To be sure, while there have been plenty of bigger down months for equities, it’s very rare for Treasuries to fall as much as this on those down months as well. Another remarkable statistic: of the 52 months where the S&P 500 has been down more than -5% over this period, 37 have seen Treasuries have a positive total return in a flight to quality trade.

In other words, it’s also a total disaster for Risk Parity and 60/40 balanced funds which are by definition long on both legs.

Obviously, the problem here is inflation, inflation which was unleashed not by Putin, or by evil oil corporations but by the Fed monetizing $5 trillion in liquidity in the past 2 years and by profligate, MMTesque fiscal policies that have sparked the worst inflationary fire the US has seen since the days of Volcker.

As Reid concludes, “if inflation structurally changes for a prolonged period we may have to get used to more periods of both being down which will be a problem for 60/40 type portfolios.” And by problem, he of course means, the end although, with stocks and bonds both set to crater much more, it is safe to say that nobody will enjoy what is coming in the market in the next few months.