Everybody has a plan until they get punched in the face

– Mike Tyson

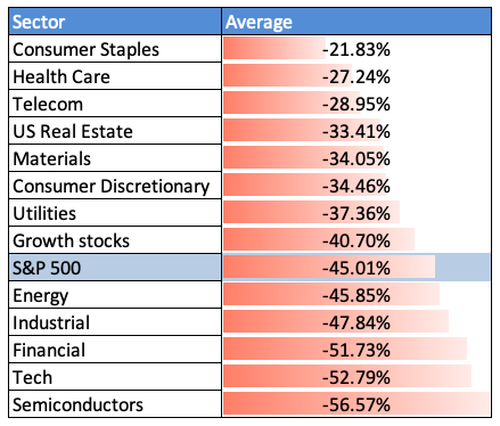

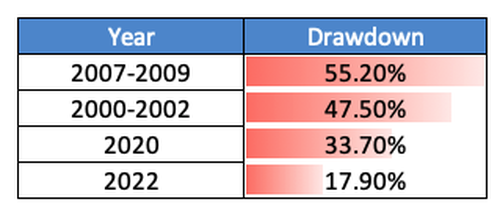

There’s no point beating about the bush here – From Twitter to the mainstream media, everyone’s talking about the market correction. The S&P 500 saw an 18% drawdown and Nasdaq is down 25% YTD, enough to get investors and traders panicking about the dream bull run ending, and wondering whether we’re entering a bear market now.

But when emotions are high and anecdotes are used to draw comparisons, there’s only one recourse – Data. We’ve seen three significant corrections over the last 20 years and studying the market’s behavior during those corrections can give us clues about what to do. Let’s dive deep into the previous corrections to understand why this isn’t the time to panic – And what you should do with your investments now.

Data

There were three major market corrections in the past – In 2000-02, in 2007-08, and in 2020. I mainly looked at data related to these periods to answer two questions:

- Should you wait, keep investing, or double down during a dip?

- Can you protect against downside risk?

I have used the S&P 500 as the benchmark for most of these backtests. The data for this article has been collected using Yahoo Finance. The analysis and data are shared at the end of the article.

Buying the dip

Markets fluctuate every day. But the reason a drawdown gets everyone’s attention is that the drop in prices is rapid, and the psychological effect is immense. The 2007-08 correction saw the S&P 500 losing value by more than 50%. Imagine seeing half the value of your portfolio seemingly evaporate overnight!

It’s very hard to hold on to your investments in such cases. The instinct is to sell at a high and buy at a low. But is it possible to do so reliably? Market timing is a tricky business and it does not work in the long run. But in the case of a market correction, should you wait out the storm before investing again, or should you double down and buy more? Let’s study the past corrections to find out.

Consider three investors: Cautious Charlie, Average Andy, and Daring Dave. Each of them invests $100 into the S&P 500 at the beginning of every month. When the market goes below 10% of the previous all-time high (let’s call this the threshold), each investor reacts differently to the dip.

- Cautious Charlie “holds” – He stops investing and waits till the market crosses the threshold again.

- Average Andy “stays” – He continues investing as usual.

- Daring Dave “doubles” – He invests double the usual amount till the market crosses the threshold again.

Who did better? Here’s how they would have performed if they had started investing in 1998:

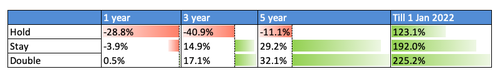

Would you look at that! At the end of 24 years, Average Andy and Daring Dave have returns of greater than 330% while Cautious Charlie has a return of about 240%. The most profitable strategy is to double down during dips, but continuing to invest as usual also does great.

But how do their average returns compare in the short term? These are the average returns if you had invested using the three strategies starting at the beginning of the last three major corrections:

Even in the short term, buying during the dip is far superior to waiting. You would have lost money by waiting but made positive returns over even a 3-year and 5-year period if you had continued to invest – and the profits of the “double” strategy are almost 2x that of the “hold” strategy where you stop investing.

The message is clear – Buy the dip if you can afford to.