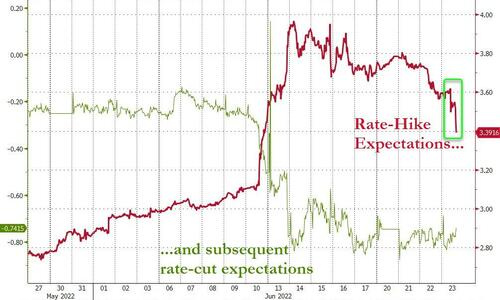

This morning’s PMIs – full of recessionary indications, forward-looking pessimism, and deflationary signals – appear to have been the straw that broke the camel’s back of hawkish expectations. Rate-hike expectations have tumbled notably and subsequent rate cuts are hovering at 75bps…

Source: Bloomberg

Specifically, the odds of 75bps rate hikes in July and September are sliding fast (68% and 22% respectively now) and for December and February, the odds of a single 25bps hike are evaporating…Simply put, the market appears to be pricing the end of this rate-hike cycle ahead of the MidTerms.

Source: Bloomberg

This ‘dovish’ shift has sent the 10Y yield tumbling back towards 3.00% – erasing all of the post-CPI spike…

Source: Bloomberg

Gold is also rallying once again….

Stocks remain confused as to whether they should sell off on recession fears or rally on the expectations of easing and QE down the line…

Is this what Powell wanted?