After first Barclays and then Jefferies caused a stir by making a 75bps rate hike this Wednesday their base case, moments ago Standard Chartered head of global FX research and NA macro strategy, Steven Englander, upped the ante once again this morning when he said that while his team expects a 50bps hike at the 15 June FOMC, he does not “preclude a hike of 75bps or even 100bps.”

The reason why such a rate hike shock is even contemplated is because, as Englander explains, neither inflation nor the economy are giving clear enough signals of slowing to deter the Fed from its path of 50bps (or more) hikes for the next couple of meetings.

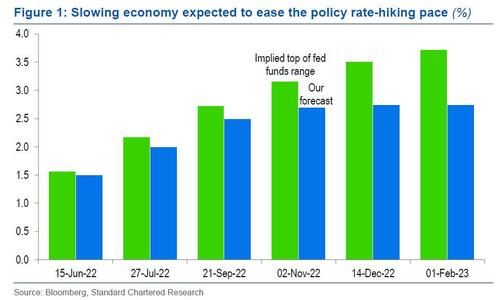

As a result, Std Chartered now expects “50bps hikes in July (previously 25bps) and 50bps in September (previously zero). We shift our 25bps December 2022 hike to November and drop our Q2-2023 hike (previously 25bps), leaving us with a terminal rate of 2.75% (previously 2.25%).” Some more thoughts from the bank:

Fed funds already essentially price 50bps per meeting for the rest of the year, so pointing to 50bps hikes for the next couple of meetings is not particularly hawkish at this stage. On the contrary, any indication of a pause or downshift in H2 would be a dovish surprise. The FOMC’s language on fighting inflation is clear, but they have already conveyed that sufficiently to markets.

* * *

There is widespread expectation that the 2022 and 2023 SEP projections for fed funds will be significantly higher – in fact, almost all FOMC participants have signalled that a quick move to neutral would be appropriate (keeping in mind that Lisa Cook and Phillip Jefferson have not made major policy speeches since joining the Board of Governors). We expect the median end-2022 fed funds SEP projection to be around 2.75%, but if we are wrong, the median is more likely to be 3% than 2.5%. This reflects a view that some FOMC participants would have shifted up their equilibrium fed funds projection and that some may feel a need to go beyond.

We expect the FOMC’s end-2023 median fed funds projection to go to around 3.25% and pull back to 3% in 2024. In March, we already had five participants above 3% and three just below. We doubt that the SEP will take end-2023 fed funds to 3.5% but see it as a hawkish risk. The FOMC taking end-2023 projected fed funds to 3.25% and keeping it steady is hawkish, suggesting concerns that tight money and below-potential growth will have to persist for a significant length of time.

What is more remarkable is that the FX strategist does not “preclude 75bps and even see an outside chance of 100bps at the 15 June meeting.” However, since this is not a Fed that likes to surprise, and the drop in consumer confidence is shocking and suggesting a recession is imminent, Englander retains 50bps as his June baseline.

Meanwhile, the latest rate hike odds as of this morning, show a 44% chance of a 75bps rate hike this Wednesday, rising to 7+ by Sept, meaning at least one 75bps rate hike in the next three months.

What does this mean for the market?

With about 60bps priced into the futures market, Englander notes that the first reaction to a 50bps hike would be USD weakness and bond-buying, but whether this persists will depend on the messaging on subsequent hikes. Investors are long USD and short bonds, so there is some near-term vulnerability; however, if Chair Powell is unrelentingly hawkish, investors may quickly reverse the short-term disappointment.

Conversely, a 75bps hike would be pointless if the FOMC signaled a subsequent downshifting to 25bps, so it seems likely that a 75bps hike would be accompanied by hawkish language pointing to hikes of 50bps or more in the following meetings. Our outside chance of a 100bps move reflects a risk that the FOMC sees the need for a ‘Volcker moment’, but we do not think the FOMC sees itself at that point yet and we do not see the need for such a dramatic move.

Finally, there is one more reason why the Fed is unlikely to hike 75bps (or certainly 100bps) on Wednesday, and it has to do with QT, whose impact will only be felt for the first time on Wednesday when we get a double-digit billions bond maturity and balance sheet shrinkage: as Englander notes, “Fed will be cautious in indicating a change in the pace of quantitative tightening (QT). There looks to be a strong underlying desire to avoid having two parallel tightening tracks, so most likely the message is steady as she goes.”