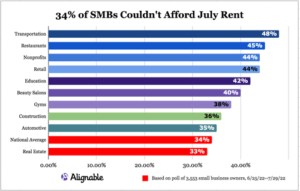

Alignable’s July Rent Report is being released right now, based on a poll that concluded this morning, conducted among 3,553 small business owners.

It shows that rent struggles are severe for several small business sectors, including transportation (trucking companies & car services), restaurants, retail shops, and beauty salons. What’s the cause according to SMBs? Rent hikes, labor costs/the ongoing labor shortage, the high price of gas, and reduced consumer spending are all combined to create economic instability.

Restaurants Couldn’t Pay Rent In July

Here are some quick highlights:

- The recovery rate for small businesses is at an all-time low of just 25%. That means 75% of small business owners have yet to earn the same monthly revenues they generated prior to COVID.

- 46% of SMBs say they’re paying higher rent now than they did six months ago.

- 45% of restaurants (up 7% from June) & 44% of retailers (up 9% from June) couldn’t afford their July rent.

- In fact, for restaurants & retailers, their rent delinquency rates in July were the highest they’ve been since the end of 2021.

- 40% of salons couldn’t make rent in July, up 15% from 25% in June.

- 48% of small businesses in transportation didn’t have enough cash to pay July’s rent.

- The overall rent delinquency rate for U.S. SMBs is 34%, just 1% shy of 2022’s highest rate (35% in June).

- The situation is a bit worse in Canada, where the rate is 37%.

- 42% of SMBs in MA, 41% in NY, 40% in IL, and 37% in MI weren’t able to fulfill their rent obligations in July.